For most of my career, I helped insurers do one thing exceptionally well: process claims efficiently.

Over nearly three decades, I worked with insurers across seven African markets, helping build platforms that now process claims for more than 40 insurers—including three of the top five in Nigeria.

We made claims faster, cleaner, and more auditable. We reduced leakage, improved turnaround time, and gave management the controls, reconciliation tools, and operational visibility required to run a modern insurance business.

That work mattered. It still does.

If you’re running an insurance operation in Africa, you don’t get to “skip” claims. You need strong core systems. You need discipline. You need governance. And for years, the industry’s definition of progress was exactly that: fewer manual steps, faster turnaround, better control, better reporting.

By that measure, we succeeded.

TurnQuest became part of the backbone of insurance operations across the continent. We bootstrapped our way from Kenya to Nigeria, Zambia, Ghana, and Tanzania—proving that African technology companies could compete globally and win. Turnkey Africa, now part of the Caava Group, continues to support insurers as they scale, modernize, and operate more efficiently.

I stepped down as CEO of Turnkey Africa last year and remain involved at board level to support its continued growth. But stepping away from day-to-day operations—and looking at the health insurance industry from a new vantage point—made something impossible to ignore:

The industry is optimizing for the wrong problem.

The Insight That Comes With Distance

When you’re inside an operating business, you’re rewarded for solving urgent problems: claims backlogs, provider disputes, reconciliations, fraud, settlement delays, reporting gaps, compliance. These problems are real, and they demand attention.

But when you step outside and look at the industry as a whole, a deeper pattern becomes visible.

No matter how good claims systems become, claims keep rising.

No matter how much we invest in control and fraud detection, loss ratios remain stubborn.

No matter how many wellness benefits are introduced, utilization stays low and late care remains normal.

In other words, we’re getting better and better at managing the downstream mechanics—while the upstream drivers of cost keep accelerating.

From the outside, this looks less like a technology gap and more like a system design gap.

We were optimizing the plumbing—while the tap was wide open.

Claims Are Symptoms, Not Events

Here is the insight that crystallized with distance:

A claim is not an event. It’s the receipt—the symptom.

By the time a claim hits an insurer’s system, several things are already true. Someone has often been sick for years. Risk has compounded. Costs have escalated. The highest-leverage choices were missed months—or years—earlier.

Claims systems live after the damage is done.

Yet almost all industry technology, capital, and executive attention sits downstream—authorizing, processing, reconciling, disputing, and paying.

That’s not because anyone is incompetent. It’s because the system was built that way. Healthcare financing waits for sickness, then responds. Insurance technology followed the same logic.

We optimize claims processing because that’s what the industry asks for, rewards, and measures.

The Industry Needs a Yellow Card

A personal experience from a few years ago gave me language for this systemic gap.

During a routine check-up, my doctor paused while reviewing my results. Nothing dramatic. No emergency. No red flags—yet. But the trendline wasn’t good.

She was direct:

“Your biomarkers are trending in the wrong direction. If you don’t reverse course now, you’ll be dealing with serious problems in a few years. Think of this as your yellow card.”

That phrase stuck with me.

Not a crisis, but a warning.

Not an event, but a trend.

My doctor wasn’t waiting for a heart attack to intervene. She was acting early, based on trajectory rather than catastrophe.

It struck me as a perfect metaphor for what payers and employers face every day—except most of our systems have no way to issue yellow cards at scale. We wait for the “red card”: the hospitalization, the complication, the catastrophic claim—and then we respond.

That’s the difference between:

Medicine 2.0: wait → treat → pay → repeat

Medicine 3.0: detect early → engage → intervene → measure outcomes

The Metrics of “Success” Need to Shift

Once you see the problem this way, you start asking different questions.

What are we actually optimizing for?

Why do chronic disease claims keep rising despite better technology?

Why do wellness programs consistently underperform despite growing investment?

If the top 10% of patients consume over 60% of healthcare spending—and their conditions develop predictably over years—why are we waiting until they cross that threshold?

The data is difficult to ignore. Only a low single-digit percentage of global health spending goes to prevention, despite prevention delivering strong returns. In Kenya, most medical insurers have sustained underwriting losses for years. Wellness programs show strong ROI potential, yet participation often remains in single digits.

The problem was never that our insurance technology was wrong.

The problem is that it operates too late.

No matter how efficient claims processing becomes, claims will keep growing if we intervene only after disease manifests. No matter how sophisticated fraud detection gets, loss ratios will remain under pressure if we address problems only once they’re expensive.

The issue isn’t faulty technology.

It’s incomplete technology.

Prevention doesn’t need better claims systems.

It needs a completely different layer.

Why Zimasa? Why Now?

That realization led me to found Zimasa.

The Zimasa Health Engagement Platform is built on a proven medical insurance core that has served African insurers for more than 20 years. We modernized that foundation, deepened our health data and AI capabilities, and then built what was always missing:

The Engagement Operating System.

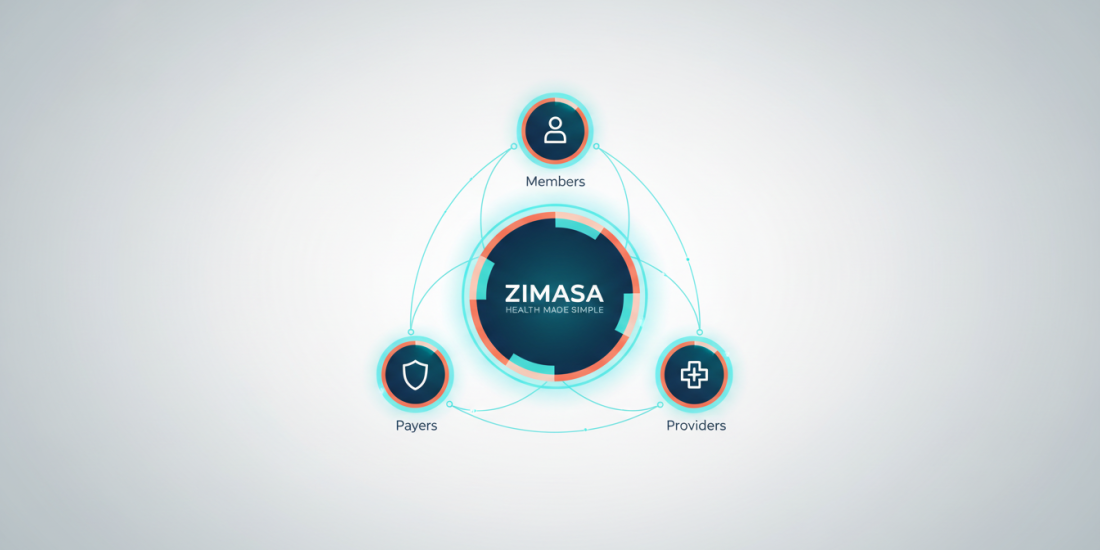

A system that sits between payers, employers, providers, and members—and intervenes before claims happen.

It identifies rising risk early, reaches members proactively through channels they already use, makes action effortless, sustains behavior change over time, and closes the loop with outcomes data.

This isn’t claims technology adapted for prevention.

It’s prevention technology built from the ground up.

What Comes Next

In the next—and final—article in this series, I’ll introduce Zimasa: The Health Engagement OS for Africa.

I won’t just describe it. I’ll show how it works.

How AI-powered engagement drives 60–70% participation instead of industry single digits.

How payers and employers finally get real-time visibility into ROI.

How success shifts from documenting sickness to preventing it.

After nearly 28 years helping insurers measure success by claims processed, I’m convinced the industry’s metrics must change.

The future of healthcare in Kenya and across Africa will belong to those who measure success not by how efficiently they document failure—but by how effectively they prevent it.